For Freight Accounting Teams

Keep your Bank and TMS perfectly in sync

No more applying cash. No more searching for payments. No more keeping notes about transactions, invoices, and payables in printouts and spreadsheets.

Monitor automates work and unifies payments data to help freight accountants run their financial operations effortlessly.

Financial data at your fingertips

Monitor puts payments at the center of your brokerage by matching transactions to the right business objects in your TMS.

- Drive efficiency and reduce errors

Eliminate manual work by automating cash application.

- Accelerate your financial operations

Recognize revenue right away. View the payment status of each load in real-time.

- Focus on actions that move the needle

Free time for high-impact work – collections, credit, customer and carrier analyses etc.

Product Features

Full automation. Complete control.

Centralize your data for matching

Monitor unifies and structures your payments data and your TMS data for continuous cash application.

- Import payments data via bank file and remittance parsers.

- Stream invoice and payable data into the platform for always-on matching.

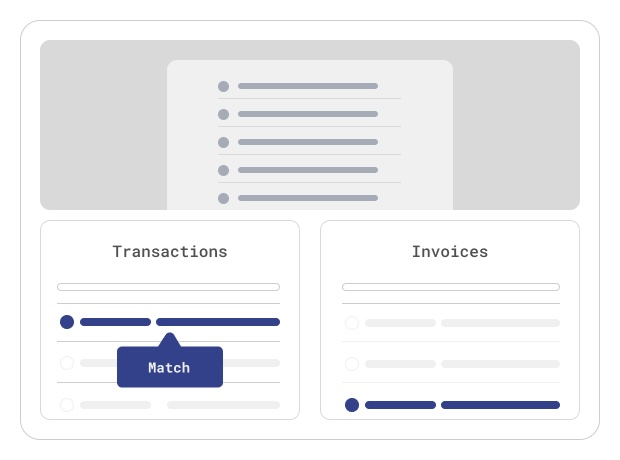

Apply cash with speed and precision

Powerful algorithms tie each transaction to the correct business object.

- Apply transactions using two- or three-way matching patterns.

- Create custom rules to automate edge-cases, such as multiple payer names and reference numbers.

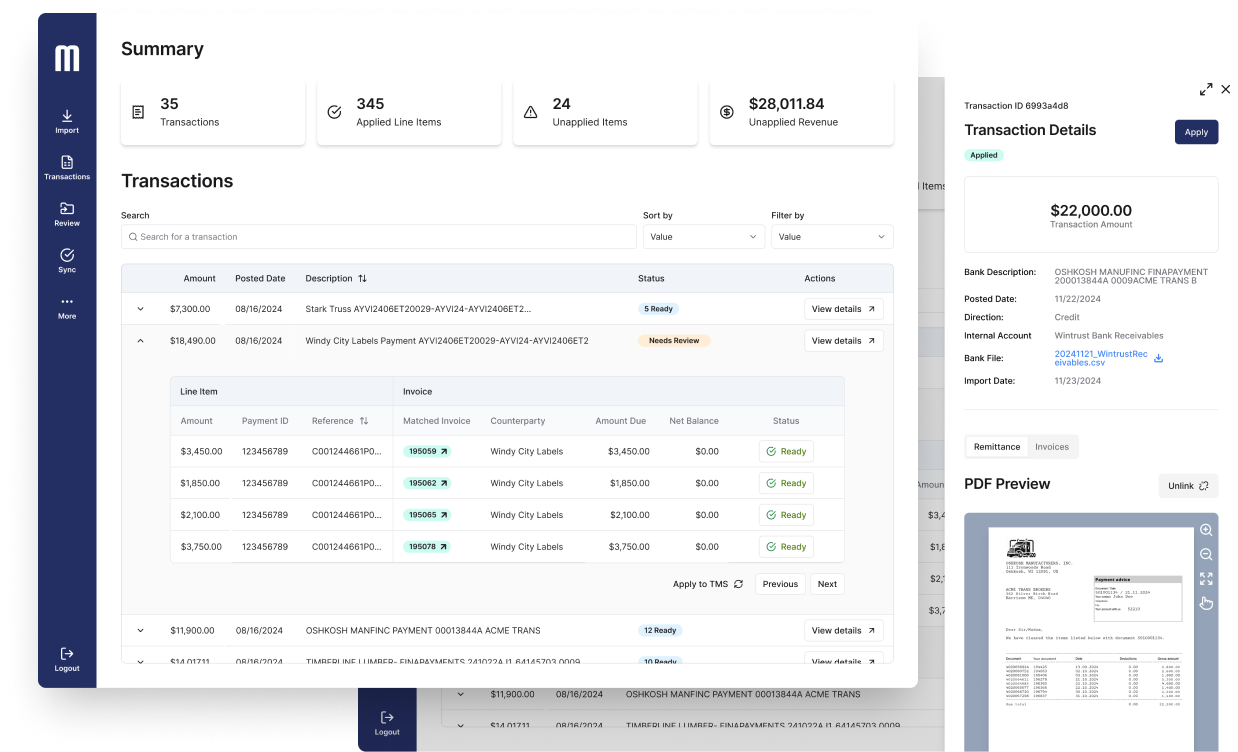

Let no exception slip through

Track unmatched exceptions and apply by hand in a simple and transparent dashboard.

- Match unapplied transactions at blazing speed with match suggestions.

- Record customer follow-ups and to-dos with notes and case management tools.

Sync with confidence

Review applied cash in one place. Sync data back to your TMS to keep your records up-to-date.

- Confirm applied transactions and their matched invoices and payables.

- Update records automatically with pre-built TMS and accounting integrations.

Plug and Play

Integrations to keep your data in sync

Pre-built TMS and accounting integrations ensure your data is always up to date.

Frequently asked questions

Cash application is the process of matching bank payments to open invoices and payables in your business system of record.

Cash application helps answer critical business questions:

- Have customers paid us for our services?

- Have we paid carriers for their services?

- Are we getting paid the right amount at the right time?

- Are we paying carriers the right amount at the right time?

Automated cash application improves productivity by eliminating time spent manually attributing each payment to an invoice or payable.

Additionally, automated cash application provides real-time data that helps brokers run your back office more efficiently. This includes following up on collections, responding to carrier payment status requests, and troubleshooting returned payments.

Monitor automates your brokerage’s cash application by automatically applying your bank payments to the correct operational item in your TMS or accounting system.

Yes, Monitor works across multiple TMS(s), WMS(s), and accounting systems.

Monitor sits on top of your TMS or WMS systems, allowing your brokerage to unify all open invoice and payable data across your numerous platforms.

Monitor unifies your financial data, applies cash against that data, and then syncs data automatically back into the correct system of record.